Navigating the world of insurance can feel like deciphering a complex code. While insurance policies promise protection from unexpected events, they also come with a critical component that can significantly impact your coverage: exclusions. Understanding these exclusions is crucial to ensuring you’re adequately protected and avoiding unwelcome surprises when filing a claim. This guide will break down coverage exclusions, providing you with the knowledge to navigate your insurance policies with confidence.

What are Coverage Exclusions?

Defining Coverage Exclusions

Coverage exclusions are specific circumstances, events, or types of damage that an insurance policy explicitly does not cover. They define the boundaries of what the insurer will not pay for in the event of a loss. These exclusions are a fundamental part of any insurance contract and help insurers manage risk and keep premiums affordable.

Why are Exclusions Necessary?

Insurance companies use exclusions to:

- Manage Risk: By excluding certain high-risk scenarios, insurers can accurately assess their potential liabilities.

- Control Costs: Covering every conceivable risk would make insurance prohibitively expensive for most people. Exclusions help keep premiums manageable.

- Prevent Moral Hazard: Excluding intentionally caused damage discourages policyholders from deliberately causing losses to collect insurance money.

- Avoid Duplication of Coverage: Exclusions can prevent overlapping coverage with other insurance policies you might have.

Common Misconceptions About Exclusions

Many people mistakenly believe that their insurance covers everything. This is a dangerous assumption. It’s vital to read your policy documents carefully and understand what is not covered. A recent study by the Insurance Information Institute found that nearly 40% of homeowners are unaware of common exclusions in their homeowners insurance policies, highlighting the importance of education on this topic.

Types of Coverage Exclusions

Standard Exclusions in Homeowners Insurance

Homeowners insurance, while providing essential protection, has several typical exclusions:

- Earth Movement: Damage caused by earthquakes, landslides, and sinkholes is generally excluded. You’ll usually need a separate earthquake policy for this. For example, a homeowner in California whose house is damaged by an earthquake would not be covered by standard homeowners insurance.

- Flooding: Damage caused by flooding, including heavy rainfall or storm surge, is not covered. You’ll need a separate flood insurance policy, often through the National Flood Insurance Program (NFIP).

- Neglect: If you fail to maintain your property, leading to damage, the insurer may deny your claim. For example, a leaking roof that has been ignored for years may not be covered when it finally collapses.

- Intentional Acts: Damage caused intentionally by you or anyone residing on your property will not be covered.

- Wear and Tear: Gradual deterioration, such as a worn-out roof or faded paint, is not covered.

- Pest Infestations: Damage from termites, rodents, or other pests is often excluded.

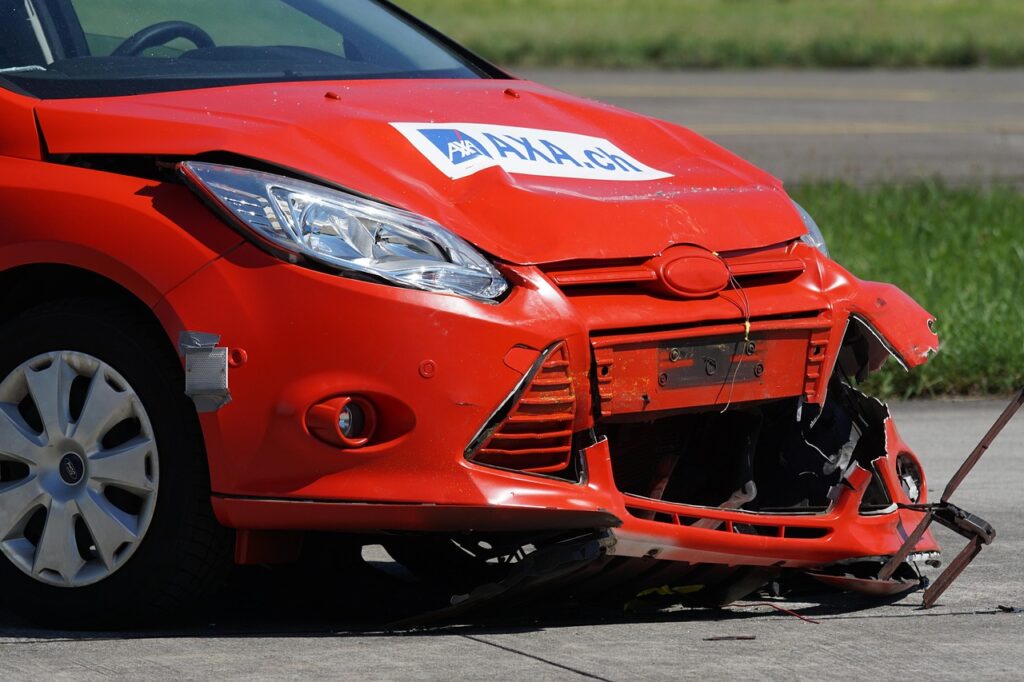

Common Auto Insurance Exclusions

Auto insurance policies also have specific exclusions:

- Intentional Damage: Just like homeowners insurance, intentionally causing an accident will void your coverage.

- Driving Under the Influence: Accidents occurring while driving under the influence of alcohol or drugs are generally excluded.

- Using Your Car for Commercial Purposes: If you’re using your personal vehicle for ride-sharing or delivery services and haven’t informed your insurance company or purchased a commercial policy, you might not be covered.

- Unlicensed Drivers: If an unlicensed driver is operating your vehicle and causes an accident, your insurance may not cover the damages.

- Wear and Tear/Maintenance: Damage resulting from normal wear and tear or lack of maintenance is typically excluded.

Health Insurance Exclusions

Health insurance policies also have exclusions, although they vary widely:

- Cosmetic Surgery: Unless deemed medically necessary, cosmetic procedures are generally excluded.

- Experimental Treatments: Unproven or experimental medical treatments might not be covered.

- Pre-existing Conditions (Less Common Now): While the Affordable Care Act (ACA) has significantly limited pre-existing condition exclusions, certain grandfathered plans might still have them.

- Vision and Dental (Often Separate): Coverage for vision and dental care may require separate insurance policies.

- Alternative Medicine: Coverage for alternative therapies, such as acupuncture or chiropractic care, can vary significantly depending on the policy.

How to Identify and Understand Exclusions

Reading Your Policy Documents

The most crucial step is to carefully read your insurance policy documents, paying close attention to the section on exclusions. Don’t skim; read each exclusion carefully and try to understand its implications.

Asking Questions

If you find the policy language confusing, don’t hesitate to contact your insurance agent or company representative. Ask them to explain any exclusions you don’t understand and provide real-life examples of situations where the exclusion would apply.

Seeking Professional Advice

Consider consulting with an insurance broker or financial advisor who can help you understand your coverage and identify potential gaps in your protection. They can provide objective advice and help you choose the right insurance policies for your needs.

Utilizing Online Resources

Many insurance companies provide online resources, such as FAQs and glossaries, to help you understand your policy. Websites like the Insurance Information Institute (III) and the National Association of Insurance Commissioners (NAIC) also offer valuable information and educational materials.

Minimizing the Impact of Exclusions

Purchasing Additional Coverage

If you identify exclusions that leave you vulnerable, consider purchasing additional coverage. For example, if you live in an area prone to earthquakes, purchase earthquake insurance. If you live in a flood zone, purchase flood insurance.

Maintaining Your Property

Regularly inspect and maintain your property to prevent damage that might be excluded due to neglect. This includes repairing leaks, trimming trees, and keeping your home in good condition.

Being Honest with Your Insurer

Provide accurate information to your insurance company when applying for coverage. Concealing information or misrepresenting facts can lead to denied claims or even policy cancellation.

Reviewing Your Policy Annually

Your insurance needs may change over time. Review your policies annually to ensure they still provide adequate coverage and to address any changes in your risk profile. This is also a good time to identify any new exclusions or changes to existing ones.

Common Mistakes to Avoid

Assuming You’re Covered

The biggest mistake is assuming that your insurance covers everything. Always read your policy documents carefully and understand what is not covered.

Ignoring Maintenance

Neglecting to maintain your property can lead to denied claims due to exclusions for neglect. Regularly inspect and maintain your home and vehicle to prevent problems.

Failing to Update Your Policy

As your life changes, so do your insurance needs. Failing to update your policy can leave you underinsured or without coverage for new risks.

Misunderstanding Policy Language

Insurance policies can be complex and difficult to understand. If you’re unsure about something, don’t hesitate to ask for clarification from your agent or insurer.

Conclusion

Understanding coverage exclusions is paramount to protecting your financial well-being. By taking the time to read your policy documents, asking questions, and purchasing additional coverage when necessary, you can minimize the impact of exclusions and ensure you have the protection you need. Don’t wait until a loss occurs to discover what’s not covered. Be proactive and take control of your insurance coverage today.